|

|

The Bitcoin Bedtime Story

Posted by Pile

(13168 views) |

|

How do you explain crypto currency to your kids? How do you explain crypto currency to your kids?Well, here's a hearwarming story you can tell them... | |

READ MORE | No comments | Comment on this Article | |

|

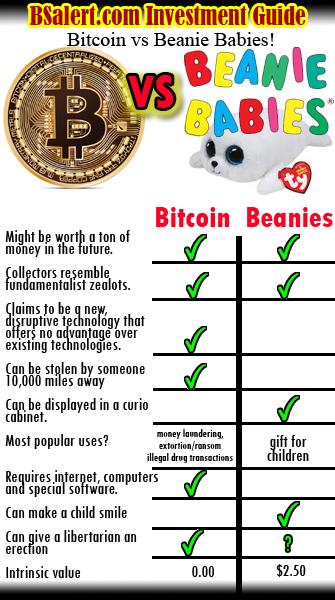

BitCoin vs Beanie Babies

Posted by Pile

(20646 views) |

[Beating Dead Horses] |

In celebration of the recent elevation in Bitcoin price, we thought it was apropos to publish a revised "investment guide".. In celebration of the recent elevation in Bitcoin price, we thought it was apropos to publish a revised "investment guide".. | |

READ MORE | 13 comments since 2024-05-07 02:20:15 | Comment on this Article | |

|

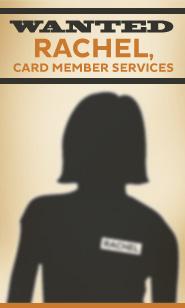

Fighting Back Against Cardmember Services Telemarketers

Posted by Pile

(16539 views) |

|

If you have not been annoyed by this operation, consider yourself lucky, but many people know what it's like to get the "Rachel from Cardmember Services" (Bridget or another phony name) robo-call repeatedly to their telephones. The group behind this operation uses social engineering to con random callers out of their credit card numbers, SSN and other personal information under the guise of helping them get a lower interest rate on their credit card debt. If you have not been annoyed by this operation, consider yourself lucky, but many people know what it's like to get the "Rachel from Cardmember Services" (Bridget or another phony name) robo-call repeatedly to their telephones. The group behind this operation uses social engineering to con random callers out of their credit card numbers, SSN and other personal information under the guise of helping them get a lower interest rate on their credit card debt.The FTC is actively trying to track down this group and not apparently having much luck. But a group online has managed to ID these people and can use your help to bring them to justice. | |

READ MORE | 4 comments since 2014-12-24 13:13:09 | Comment on this Article | |

|

A Modern Version Of SchoolHouse Rock: How America Collapsed

Posted by Pile

(14035 views) |

|

Ed Asner does voiceover for a clever animated video that talks about how American society has changed over the years and how taxation and corporations have sucked dry, the economy. In the style of the old "Schoolhouse Rock" cartoons... Ed Asner does voiceover for a clever animated video that talks about how American society has changed over the years and how taxation and corporations have sucked dry, the economy. In the style of the old "Schoolhouse Rock" cartoons... | |

READ MORE | No comments | Comment on this Article | |

|

Is The Government Rewarding Speculators And Penalizing Savers?

Posted by Pile

(12603 views) |

|

| Max Keiser looks at the ongoing financial crisis and asks whether the government and Central Bank remedies are penalizing workers and savers. Is this what capitalism is ultimately all about? Not saving money and creating solid wealth and equity, but continually leveraging what you have to get more without a solid foundation? And in the current economic mess, are the people who were responsible with debt and their money the ones who are getting the worst deal? | |

READ MORE | No comments | Comment on this Article | |

|

Peter Schiff: Government Is Contributing To The Depression

Posted by Pile

(12788 views) |

|

| The only finance guy who correctly predicted the mess the country is in has now come out commenting on the current administration's plan to address the economic crisis. As usual, Peter Schiff has some interesting things to say... | |

READ MORE | 2 comments since 2009-03-30 14:23:21 | Comment on this Article | |

|

A Coin Toss Is Better Than Listening To Jim Cramer

Posted by Pile

(15400 views) |

[Pundits] |

In a not-so-shocking analysis of one of the most-watched TV investment advisers, author Eric Tyson argues that Jim Cramer's actual stock-picking performance doesn't match the strength of his bellowing. In a not-so-shocking analysis of one of the most-watched TV investment advisers, author Eric Tyson argues that Jim Cramer's actual stock-picking performance doesn't match the strength of his bellowing.Besides his show Mad Money, Cramer is all over CNBC dispensing investment advice left and right. He's got to be out-performing other investment advisers and especially the market, right? Not really. | |

READ MORE | No comments | Comment on this Article | |

|

Citigroup Barrs Investors From Selling Their Hedge Fund Shares

Posted by Pile

(11718 views) |

|

| Citigroup has barred investors in one of its hedge funds from withdrawing their money, and a new leveraged fund lost 52 percent in its first three months, the Wall Street Journal reported Friday. The largest U.S. bank suspended redemptions in CSO Partners, a fund specializing in corporate debt, after investors tried to pull more than 30 percent of its roughly $500 million of assets, the newspaper said. Citigroup injected $100 million to stabilize the fund, which lost 10.9 percent last year, the newspaper said. | |

READ MORE | |

|

BSAlert Show 7: Money, Debt and Finance

Posted by Pile

(28555 views) |

[BSAlert *exclusive*] |

How does credit really work? Do you have nearly as much money as you think, or is debt consuming you? And how does the American financial system work? How does credit really work? Do you have nearly as much money as you think, or is debt consuming you? And how does the American financial system work?We delve into these issues as well as interview moviemaker, Paul Grignon and talk about his very cool documentary called, "Money As Debt". Click here to subscribe to our podcast via iTunes or other services (Always Free!) | |

READ MORE | 2 comments since 2008-01-21 19:29:40 | Comment on this Article | |

|

Day Trader Meltdown As Wizards Try To Cast Anti-Recession Spell

Posted by Pile

(13296 views) |

|

| Yesterday was an interesting day in the world of financial markets, if you think seeing a huge storm heading your way "interesting," and today it gets even more "interesting." Hoping to halt a market meltdown and prevent a recession, the Federal Reserve lowered its overnight lending rate by three quarters of a percentage point to 3.50% on Tuesday in a rare move between formal meetings. Nobody watches NASCAR to see cars go around in circles. We know what makes the highlights... watch the video we have as this day trader suddenly realizes the market has raped him hard... | |

READ MORE | No comments | Comment on this Article | |

|

The Corruption That Is Modern Banking: Money As Debt

Posted by Pile

(20263 views) |

|

Here is a multi-part video documentary on how the banking system works: Money As Debt. It's quite enlightening. Here is a multi-part video documentary on how the banking system works: Money As Debt. It's quite enlightening.Stay tuned as we interview the man responsible for this film, Paul Gringon in our next podcast! | |

READ MORE | 2 comments since 2008-01-23 20:19:08 | Comment on this Article | |

|

"Maxxed Out" - America's Debt Crisis

Posted by Pile

(13059 views) |

|

| In "Maxed Out", author/director James D. Scurlock takes on America's debt crisis. Consequently, he touches on related issues like race, corporate malfeasance, and political subterfuge. The full movie is here. | |

READ MORE | 3 comments since 2008-05-17 00:35:13 | Comment on this Article | |

|

JP Morgan-Chase Accidentally Loses 2.6 Million Users' Data

Posted by Pile

(11189 views) |

|

| About 2.6 million current and former Circuit City credit card account holders are being notified by credit card vendor Chase Card Services that five computer data tapes containing their personal information were mistakenly identified as trash and thrown away by Chase personnel in July. | |

READ MORE | No comments | Comment on this Article | |

|

Patriot Act Invasive Paranoia Coming To A Bank Near You

Posted by Pile

(10933 views) |

|

| In an effort, supposedly to combat terrorism and money laundering, banks will be spending billions of dollars over the next few years on software that will automatically track suspicious financial transactions, but will also monitor millions of innocuous ones, make it harder to cheat on taxes and force consumers to end up having to answer to the government for unusual banking patterns or even something like cash deposits or unusually-timed transactions. I guess it's only called "suspicious" when it doesn't involve a Fortune 500 company or a politician. | |

READ MORE | No comments | Comment on this Article | |

| 14 Articles displayed. |

Bumper Sticker Store

Bumper Sticker Store