|

|

Is Blockchain/Crypto Currency Investment A Risky Scheme?

Posted by Pile

(68710 views) |

[Essential Factoids] [BSAlert *exclusive*] |

There's tremendous hype all over the Internet and the media about Bitcoin, crypto-currencies, "blockchain" and this new "innovative technology" that is supposedly making people rich. There's tremendous hype all over the Internet and the media about Bitcoin, crypto-currencies, "blockchain" and this new "innovative technology" that is supposedly making people rich. Or is it? Is crypto currency the future? Are you actually doing any "investing" when you purchase and hold crypto-currencies? Or is this an elaborate Ponzi Scheme or an outright scam? Let's cut through the chatter and reveal what you need to know about the modern state of crypto currency, the "blockchain" buzzword everybody is using, and whether this is something real, or nefarious? Is crypto currency a scam or an amazing opportunity? You can't afford to ignore the critics and skeptics if you really care about your money... Let's jump into the deep end and talk about EVERYTHING! | |

| |

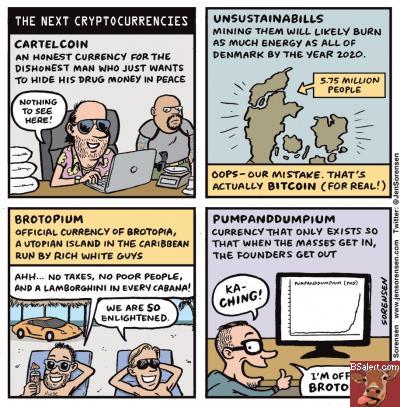

Those who have been in the industry for awhile certainly know what "crypto" is, but now laypeople are talking about it, so it's important to cover some of the basics: What is crypto-currency? In a nutshell, crypto-currency (of which there are literally tens of thousands of different systems) refers to a proposed method of trade that involves "digital currency". What does that actually mean? Digital currency? It is currency, which is unlike traditional fiat currency and exists primarily as a "digital address" and sequence of codes. Whoever has the code, owns the currency. If someone guesses/steals your code and executes a transaction with it, you just lost your crypto-currency. It's called "crypto" for short, because, supposedly the details of these codes are encrypted in various ways for your protection. What is fiat currency? Traditional fiat currency is often represented in coin and bill form, and is something you can hold in your hand and is easily transferable. In the case of the US dollar for example, it's mandated by law to be accepted virtually everywhere in your community. Yes, traditional fiat currency can also be represented in "digital form" similar to crypto currency, as indicated in computers controlling peoples' banking accounts, but is subject to much more oversight and regulation. And there's a system to quickly and easily convert your banked currency to material form if needed. Is there a material component to crypto currency? Crypto currency, sometimes referred to as "alt-coin" typically does not exist in any material form. Like "fiat currency", it's a "placeholder" that represents a certain value that is used in the exchange of goods and services between parties. But unlike traditional fiat currency, it doesn't translate well to bill, coins or other material items that can be physically exchanged. This is because what determines who owns the currency is based on who has the codes. You could print a bill that had the code on it, and that could technically be transferred to someone else, but every time crypto is transferred, these codes change. Plus a print of a code doesn't mean someone else doesn't also know the code and can take the currency without having access to the bill. What is a "blockchain?" This is a fancy new buzzword, and it's being used interchangeably with the term "crypto-currency" nowadays by various institutions who want to capitalize on the popularity of crypto. Blockchain refers to the method by which many crypto currencies keep records of transactions. A blockchain is basically a database of transactions, typically involving a few basic elements of information: the id of a buyer, the id of a seller, and a transaction amount, along with other information. This is stored in a database. It's not that much different than what might be called a "general ledger" at a bank. If a "blockchain" is simply a ledger of transactions, why not call it that? Because, "blockchain" sounds cooler and high tech! It's easier to get hedge fund managers to invest peoples' retirements into something called "blockchain" than an old, un-exciting thing called a "general ledger." (Sorry, I'm a snarky person.. couldn't resist..) What is "Fintech" and "DeFi?" These are more made-up buzzwords that people attribute to crypto-currency related activities, as if they're something new and innovative. DeFi = Distributed Finance and FinTech = Financial technology. Just more words that describe age-old processes, but repackaged as if they're something new. What is special about crypto currency blockchains? One element that distinguishes most crypto currencies from traditional fiat currency is the fact that there is no central regulation, or central repository of the blockchain (ledger). For example, with Bitcoin, when a transaction is made, details on this transaction are sent to an array of different systems that maintain blockchains. The data is compared and collected and verified after a certain process. No single entity controls the blockchain. It's de-centralized. It's also partially-anonymous. The people who execute transactions are only known by arbitrary IDs. The blockchain records that two parties exchanged currency and notes that the currency is now in the account of a different ID. The past, present and future of crypto currency - it's not what it used to be. The original concept behind crypto currencies like Bitcoin was fairly humble. And a lot different than it is now. As I type this, the value of BTC is currently $12,870 USD to 1 BTC. By the time I finish this article, there's a very good chance the value may have changed anywhere from 5-20%. It's that volatile right now. Which is dramatically different from what it was intended to be. The original concept was as a "micro-payment system" that could be used as a proxy for bartering goods and services, and in the early days, this is what happened. The value of Bitcon was fairly marginal and in and of itself, worth nothing, but if you had some BTC and could trade it to someone else for something, that was cool. The first material BTC transaction was on May 22, 2010 by Laszlo Hanyecz, a programmer who paid a fellow Bitcoin forum user 10,000 BTC for two pizzas. People harp now that the bitcoin to buy those two pizzas is now worth millions of dollars. But back then, believe it or not, the guy buying the pizza got the better deal. And you can bet the pizza seller moved his bitcoin shortly thereafter. Nobody in their right mind could have predicted that seven years later 1 BTC would be worth more than ten grand (and even now, this is arguable). In theory, crypto currencies make sense. They're supposed to be a simple, direct, peer-to-peer transaction system that is nobody else's business.  Unfortunately, that's the OLD crypto model. Now there's a new crypto model and it's completely the opposite of this. Crypto currency in its purest form was never intended to be used as a security and hoarded, or monitored based on its value in any other fiat currency. Now companies are treating crypto like stocks and offering "initial coin offerings." This is not what the originators of this technology wanted. What is crypto uniquely good for? Because of its decentralized nature and (so-called) anonymity, it lends itself to transactions between parties who aren't necessarily interested in being tracked (criminal activities, drug traffickers, money laundering, black hat transactions, and governments and people looking to move money around without others knowing). Some argue it's a way to transfer money outside of prying government eyes and taxation, but even in America, crypto currency is subject to taxation. Many industry leaders have gone on record expressing concern and/or calling crypto currencies Ponzi schemes. What should crypto currency holders be concerned about? The list of concerns is significant enough to warrant a separate article, but here are a few things that aren't as well known (NOTE: some of these vary slightly based on the crypto currency obviously but there are many generalities in common):

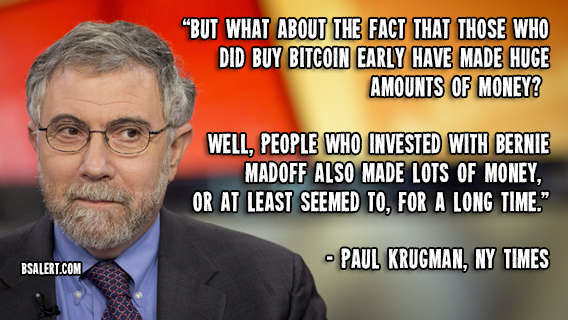

People and institutions are now looking at crypto currency as an "investment" which is absolutely, positivily NOT what it was designed to be. And for this reason, a lot of people are going to lose a lot of money falling for the hype. Crypto currency has even less intrinsic value than fiat currency. Here's what's funny. Crypto currency advocates argue that fiat currency "has no intrinsic value", therefore there's not much difference between bitcoin and US dollars. But this is a lie. Let's say it again... Crypto currency has even less value than regular currency. The US Dollar is a significantly more stable monetary concept than any crypto currency, for a number of very specific reasons:

In sharp contrast, almost all crypto currency has virtually none of these benefits. There's tremendous value in a fiat currency that you know protects you from fraud, even if it involves your own incompetence. There's tremendous value in knowing that what a dollar buys today, you will also be able to purchase tomorrow. There's tremendous value in knowing that nobody is going to look at your dollar bill and go, "WTF is that? What do I do with it?" Or charge you a $20 "transaction fee" to convert it into something else. Beyond this, there's constant controversy about whether or not the blockchain technology has become unmanageable, and the de-centralized nature is giving way to a more centralized nature of exchanges, but the more popular an exchange becomes, the more likely it is involved in fraudulent activity. But most importantly, with traditional currency at a bank, if the bank gets robbed, you're protected by the FDIC (Federal Deposit Insurance Company). And it's a lot harder to rob a bank of a million dollars than it is to break into an online exchange and instantly pilfer tens of millions in Bitcoin and other cryptos, which is now becoming common place. And when this happens, there is nothing you can do. Because you never really owned anything in the first place. You never owned anything that anybody guaranteed. You never owned anything that a majority of people in your community ever thought was of any specific value. Why Would Crypto Currency and Blockchain Systems Be Considered A Ponzi Scheme? In and of themselves, crypto is not a scam. The scam part comes with anybody trying to tell you to "invest in crypto". That's when "blockchain", "bitcoin", "crypto", etc. BECOME A PONZI SCHEME. The best way to illustrate why investing in crypto is a scam is to compare it to another popular investment: stocks. Both crypto and stocks are sold in shares and have a particular value per share. Investors buy these shares in hopes the price will go up. If they sell the shares when the price is higher they make money. If they sell when the price is lower, they lose money. That's pretty basic. There are companies now promoting crypto like stock shares, offering what are called, "ICO's" - an "initial coin offering" much like an IPO is an initial offering of public shares. It gives people a chance to buy into crypto currency in the beginning. But, THIS IS A SCAM. Because there's an inherent difference between investing in stocks verses crypto. A stock represents shares in a material organization. If you own shares in Apple, you actually are a part owner of Apple, and part owner of all the assets Apple has. Even if Apple's stock price drops, you still have a proportionate share of the company's assets. And you can determine the relative value of their stock based on the company's assets. Traditional stocks have material valuation.  In stark contrast, crypto currencies have nothing. You aren't owning anything material. You do not have a share of anything you can examine or valuate. You merely have some numbers that indicate if you can find someone else to buy those numbers at a higher price, you might be able to turn a profit, but at the end of the day, you own nothing of value and never have. With crypto currencies, the value of these shares is solely based on what you can get someone else to pay for them. This is completely arbitrary. At any point, this entire market could completely implode into nothing. That would never happen with a traditional company -- a traditional company has assets, and investors have a fiduciary duty to monitor and maintain the company's viability. There is nothing of the sort with crypto currency, except the standard network-marketing-style approach of constantly enticing other people into buying your crypto at a higher price than you paid. The Only Way You Profit In Crypto Is At Someone Else's Expense With traditional stocks, you earn profit often through the growth and success of the company. When they do well, the shareholders do well. Everybody benefits. With crypto, you only earn profit at the expense of later investors who, are now required to hype the crypto up to a higher level, in order to create profit. This is an impossible, un-tenable business model. It's the exact definition of a Ponzi Scheme. Crypto Actually Compounds The Severity Of The Problems It's Meant To Solve One sad truth about crypto-currency, is that it's a "work-around", a "hack" to the monetary system. It's not an actual solution, and in fact, it exacerbates all the troubles it promises to alleviate. For example... if you think government is too corrupt/inefficient and taxation is unfair, the solution to this problem isn't hiding money outside the system (that's not going to work anyway, and in doing so, all you do is deny tax money to the system which makes government even less efficient and capable). The solution to this problem is to fix government: make it more efficient, reduce taxation, make government work more for the people rather than special interests. The adoption of crypto is a way of saying, "I don't believe in government.. I'm going to stop trying to make it work for me, and instead work around it.." which if done on any large scale, effectively hurts the overall community. The bottom line is, government does much more good than harm, and the more people give up on trying to fix it, the more likely they're going to suffer. It's like saying, "My political leaders never seem to represent my interests, so I'm not going to vote any more." It's an absurd "solution" that fixes nothing. The same issue applies with crypto as a means to support a black market for illegal things that you think should be legal. How is that a "solution?" The real solution is to lobby to legalize, regulate and monitor the stuff you feel you shouldn't have to skulk around buying from criminals and murderers in third world countries. Crypto just compounds the problem instead of addressing it. Crypto Isn't Bad As Long As You Don't Consider It An Investment I'm not panning all crypto. It works for what it was designed. The problem is, what's going on now, with "Initial Coin Offerings" and "blockchain technology investing" is bullshit. These are people and institutions that smell money and want in on the scheme. The only way crypto would ever be ubiquitous is if it became very similar to existing fiat currency, and we have hybrid systems like this in place right now, such as credit card payment companies. So true crypto is only really useful when it's largely valueless, and used in small, inconsequential transactions (like 2 pizzas for 10k - that makes sense). Beyond this, it becomes another "Pet Rock" or "Dutch Tulip" that salespeople are trying to get you psyched over. So does this mean, "I hate Bitcoin?" Not at all. I love the idea of crypto currencies. What I hate are all the predators who are now in the market, trying to make the intangible medium, seem like a security. This makes the housing markets' "default credit swaps" look like gold bouillon. Please don't fall for it. There are better ways to create value without becoming part of a scheme that centers on misleading people. This is my big problem with Crypto currency. It's not a solution. It's a temporary hack that actually compounds the problems rather than address them. - Mark Pile, BSAlert.com | |

Related Stories:

| |

| Question Posted by Mattcwu on 2018-01-20 15:40:50 |

| You said, "With crypto currencies, the value of these shares is solely based on what you can get someone else to pay for them". Do you think that remains true for cryptos like Binance Coin (BNB), where owners get a share of the profits? |

| Posted by Pile on 2018-01-20 16:09:31 |

| What you're describing sounds more like a traditional stock than crypto currency. Any way to add some material value to a security will make it slightly more valuable, but whether that's a good investment requires more research. 100% of something that has no value still is worth 0. |

| Value Posted by anonymous on 2018-01-21 13:09:32 |

| In the section "Crypto currency has even less intrinsic value than fiat currency.", you state that crypto-currency has less value than fiat currency, and fail to provide any sources for that claim. The rest of the section describes stability of the currency, not its value. Additionally, near the top of the doc, you say "If you can refute any of the claims in this article I want to hear them, but you have to bring evidence and references.", which I find odd because you make all sorts of claims, and fail to provide references and evidence for most of them. The claims you make without evidence can be dismissed without evidence. Example: you say "Theres tremendous value in knowing that nobody is going to look at your dollar bill and go, "WTF is that? What do I do with it?" Or charge you a $20 "transaction fee" to convert it into something else.", which is false. Try converting your dollars to Euros, and I can guarantee that there will be market fluctuations, and you will be charged a transaction fee to convert it. |

| crypto currency has less value than traditional fiat currency Posted by Pile on 2018-01-22 15:43:38 |

| The exception does not prove the rule ^^ that's a fallacious argument. I fail to back up the value claim? Here's a way to test it. Go to your neighborhood store. Tell them you want to buy a bag of potato chips in Bitcoin or Ethereum. Report back to me the results. How many take Bitcoin vs how many take the traditional fiat currency? The real value of something is based on how easy it is to covert into something else. If you have a comic book that is supposedly worth $100, it's not really worth that unless you can find somebody who will pay what you think it's worth. In America, with the dollar, every single person recognizes its value. There is no question a dollar is a more useful and valuable form of currency than a comic book, or bitcoin. This really shouldn't have to be explained. It's common sense.. in fact, it's so obvious people use dollars as a way of valuating bitcoin! Regarding conversion costs... How many people buy dollars to convert into Euros or vice versa? That's not a "thing." It's only done in certain circumstances where you're moving from an area where you have to use different fiat currency. And very few people buy dollars or euros as an investment security. It's not something people can profit from very much. And as you say, there are costs in the conversion. |

| The world is a big place Posted by Anonymous on 2018-01-23 01:01:26 |

| "How many take Bitcoin vs how many take the traditional fiat currency?" You have some very strange ideas on determining the value of things. How many gas stations dont accept $100 bills? I guess they are fairly worthless. How many gas stations accept Euros? How many accept gold? How many accept van gogh paintings? Nobody has argued that ubiquity and high availability arent important factors to being a currency, but you seem to value that much larger than other folks. I can go get a BitPay debit card (https://bitpay.com/card/) that will convert BTC to USD and it will be accepted everywhere VISA is. I guess all those retailers are suckers since my BTC is worth $0! And your reply "If you have a comic book that is supposedly worth $100, its not really worth that unless you can find somebody who will pay what you think its worth." That is quite a circular argument. If I have a buyer for $100 then of course it is worth $100. Why would you just make up that it wouldnt be worth $100? "In America, with the dollar, every single person recognizes its value." Except that is not true at all. Inflation is a real thing, and a dollars purchase power is being reduced intentionally over time. So if I write up a contract to buy the comic book in 30 years for $100, are you going to take that deal because you think a dollar is worth a dollar? All currency is understood by its purchasing power which is constantly changing. Perhaps not 1500 like BTC, but it really is changing all the time. "How many people buy dollars to convert into Euros or vice versa?" I will also throw out an equally random value since you have no clue, but 95 of all people traveling between US and Europe will care. It is a "thing". It is also a "thing" for people to move their money to other country currencies (https://www.thebalance.com/how-to-invest-in-foreign-currency-1978918) and the number of people is 8 digits (since weve just been making up numbers). You can buy your own ETF if you think the Euro will do very well over the Dollar. Or I heard a tip that the Indias growth is excellent, you might want to diversify and get some Rupees (https://screener.fidelity.co m/ftgw/etf/goto/snapshot/snapshot.jhtml?symbols=INR) at your preferred trading platform. I am just trying to open your mind to the world. You are dismissing huge financial markets because of your own bubble. Just because your friends arent using rupees to buy gas doesnt mean they dont have value. Crypto has value just as everything else. Perhaps it is 0.00000001, then is it that. Or perhaps it will grow to be as useful as the Bolívar, or rupee, or even the magical dollar. Please take a step back and consider that the world is a bigger place than you think. |

| Posted by Pile on 2018-01-23 10:10:30 |

| Did you read my article at all? Or did you merely react to the title? It's becoming very frustrating, those that argue against me, seem to be arguing against a strawman position that does not represent what the article is about. I am not against crypto currency. I'm all in favor of it. Being used in the way in which it was designed. But that is NOT as an investment device, like a stock share. None of the arguments you made negate anything I've claimed in the article. Also, your main argument centers around what's called a "false dichotomy", suggesting that if you can find a similar scenario between crypto and the dollar, that somehow negates my claims, as if both types of currencies have either the same usefulness, or the same liabilities. The problem with this is, it assumes there is no middle ground, there is no way to gauge the difference between bitcoin and the dollar, but there is, because every retail outlet in America uses the dollar, and a tiny, tiny fraction use crypto currency -- this distinction is important, and you keep ignoring it. I'm not against more people accepting crypto currency, but one reason why they can't, isn't because it is bad, but because certain people are now using the currency itself as an investment, buying-and-selling it in exchange, not for products and services, but for dollars, or yen or rubles, which is not what it was designed for, and they're making the price fluctuate so dramatically it can't be used for the purpose it was originally intended. |

| Again... Posted by Anonymous on 2018-01-23 11:24:37 |

| I did read your article. My examples are not a false dichotomy my examples just serve to illustrate that investments come in many different forms. You even have a bolded section title "The Only Way You Profit In Crypto Is At Someone Elses Expense". I am specifically trying to address your main point that crypto is not for investing and that purchasing it is contributing to a ponzi-esque scheme. Let me may lay out an accurate scenario that is is not at anyones expense. There are 16.8 million BTC coins available, with a maximum of 21 million (assuming the protocol doesnt change). The most basic economic model of a linaer supply and demand curve. If I think BTC will be grow from a retail presence of 0.1 to 30 over the next two years, why would I not pre-purchase BTC now and wait for the demand to grow as I expect? From a retailers perspective that isnt interested in margin trading rubles, yen, bitcoin, or oil futures, they just want to receive a specific sale price in their countrys primary currency. Retailers would not care if that is 1 BTC or 1 mBTC. As long as the volatility is low from the time they receive the BTC to converting it to their currency of choice (and Coinbase and BitPay are guaranteeing this as the point of sale, within a second), then the retailer would not care. That facilitates increasing demand which dilutes the fixed supply, and the USD/BTC pair goes up. I think the crypto community would 100 agree with you that crypto-currency can facilitate a Ponzi scheme (see Bitconnect) because of how easy it is to become disconnect from your money without clear recourse. It is difficult to bring a lawsuit against a company that took your money and promised 20 weekly returns (e.g. Bitconnect). Of course it can be done and it probably will, but I disagree that investing in crypto means it is a Ponzi scheme. If I have miss-characterized any of your points, or quoted you out of context, please be specific. I am an honest actor. I am happy to go line by line and bring additional clarity if you are interested. IMO, crypto-currency is going to provide a whole new ecosystem of brilliant ideas to improve peoples lives. There will be new dApps (distributed apps) built on top of different crypto-currency frameworks, and it will become ubiquitous in our culture. That doesnt mean scams wont be prevalent. P.S. I am not sure why your comments are filtering out semi-colons. I apologize if my grammar appears awkward at times. |

| Posted by Pile on 2018-01-23 11:43:54 |

| I understand where you're coming from and agree. I should probably adjust my article because I don't want to imply that "crypto is a ponzi scheme" but I do believe, as you say, that it lends itself, very well, to playing a primary role in Ponzi style activities. But I still contend, "investing" in crypto is not good for crypto. It's only good for investment brokers who seek to profit by taking other peoples' money. |

| Challenge... Posted by Anonymous on 2018-01-23 23:55:51 |

| Well I will also challenge you on that point as well. I suggest the increase in value of cryptocurrencies is equivalent to raising venture capital to move a project forward. There is no longer a need to go to rich people and dilute the equity of your company behind closed doors and out of the public eye. Now you can go straight to the public, and the public will vote with their dollars if your ideas are good or not. If you have a working product, a public repository of code, and I can use and see the product in action, I can decide to buy up the supply (invest), increasing demand, and increasing the price. That gives the larger stake-holders more buying potential to expand the team, improve the technology, improve the infrastructure, and move the road-map forward. The Monero community (https://www.reddit.com/r/Monero/) has a clear example of this. Early investors of Monero are paying monthly stipends to the Monero Research Lab (https://lab.getmonero.org/) based on their work proposals. Researching new ideas, implementing proof of concepts, creating education material, and improving the protocol are all being funded by the increase in value of Monero. There are similar examples across the crypto community. Bounty programs have been around since the early days of Bitcoin. Ethereum has an active bounty program (https://bounty.ethereum.org/). It is primarily early investors that have seen the returns, contributing back to the ecosystem and helping it grow. The majority of investors in crypto are not partaking in the above communities. But the simple act of buying supply and increasing demand effectively does do the above. And I will again add a caveat that yes, there is plenty of room for scams in the above scenarios. Someone can make ShillCoin and copy/paste a bunch of code and pretend like they are revolutionizing monetary policy. But I still assert the majority of cryptocurrencies are not such blatant scams, and are using the increased value to grow the technology. I will also add a caveat that, yes, the majority of the coins need nowhere near as much capital as they ended up raising. But I think that just goes to the thirst of people wanting to invest in the future. Crypto-currency has extremely high risk, yes, but it also has that potential to be very rewarding, both as an early investor and as a non-investing user. Cheers. P.S. Comments are also filtering out percent signs! |

| Very High Risk Posted by Pile on 2018-01-27 10:57:17 |

| I think we both agree, ultimately, this is a very "high risk" area of "investment." I would challenge your claim that the majority of crypto currencies are not "scam-like". The majority of them have no real-world assets backing them. This is one of the basic things that a fiat currency typically requires in order to get started. The currency token has to have some real-world representation of some asset of value. Even if the value of that asset is volatile, it's still an asset. Early coins were minted in precious metals. Beads and other items used as currency represented craftsmanship and work in a tangible form. Crypto doesn't have anything like this. In addition to losing the value of crypto, you have no asset backing it up. But more importantly, is usability. If you own an item, even an intangible digital item, the ease at which you can trade it for goods and services is the primary determining factor of its ultimate value. So you need a ton of useful places to accept the currency and/or very reputable institutions that can convert it. Right now, that does not describe crypto. Perhaps a better solution is to start employing stock trading using a public blockchain? Then you can invest in actual companies? |

| The Irony of Crypto Posted by Pile on 2019-02-14 18:54:33 |

| Here's a post made by someone on Reddit that I want to reprint here in case it disappears: The Irony of Crypto by wballs (https://old.reddit.com/r/Buttcoin/comments/aqli5z/the_irony_of_crypto/) Big banks are evil. Fees, control over your money, crazy profits and fat cat executives! They are to blame for the financial crash we need our own banking system and currency to stop them ruining our lives! The solution? Create new unregulated banks (aka exchanges) with no accountability, poor security, insane fees, manipulation of prices, wash trading and the fattest of fat cat execs along with well timed ‘outages’ preventing people from trading at the exact times they need to get in or out. Imagine you were paid your salary from your workplace into your bank account, but for some reason the money didn’t show up. You’d be quite inconvenienced and livid to say the least. You would chase up with you work and of course the bank. You would expect answers within days at the most a week. Not being paid for a month would be outrageous potentially making headlines. But in the crypto world tens of thousands of dollars sit in limbo for weeks, often months with little or no communication from the exchange about where the money has gone. Every positive of banking is lost in this world. Quick access to your funds, little to no fees for deposits, withdrawals, even account upkeep. The reliable security, uptime, support, chargebacks. The bank cards, apps, atms, pos devices, sheer ability to use your bank/credit card at hundreds of thousands of locations worldwide in an instant. All of this is worth throwing in the toilet and starting over because why? I want control of my money! Somehow having your assets in a cold storage wallet is superior to having your money sitting in a secure high interest account or just sitting in gold bars in your safe. No it would be much smarter to have it in a virtual wallet accessible only by the owner while he can remember his passphrase and providing he hasn’t lost his physical device or key. It seems the thrill of being able to lose your entire life savings in a single house fire or flood is attractive to this tribe. And then there’s the “currency”. These age old concepts of monetary policy, federal banks, interest rates, taxes, funding government projects and infrastructure, home loans, business loans and regulations are all just window dressing. None of this is actually required. Apparently you could just start distributing a new ‘coin’ and it will take over the world! All that matters is who will accept the coin. The idea that a central authority may play some part in protecting that currency from wild fluctuations in value is a total fantasy. The concept that the federal reserve plays any part in the running of an economy, such as how easy it might be for consumers and businesses to obtain home and business loans is just completely ignored. The reasons behind why a coke would remain below $2 during the 2008 financial crisis are a complete mystery. The concepts of quantitive easing, government funding, issuing of bonds, exchange rates between different currencies and their reasons for moving are all completely foreign to the crypto fanboy. In the search for a world currency the fact we do not live in a world economy is completely lost. While one country may be in a recession, others will be booming. Each country has their own economy which needs managing and during times of boom requires tampering down, and during tougher times requires stimulation and a halt on inflation. A single currency across the world completely ignores this fact. Each country’s economy is complex interconnected system with many moving parts like a car’s drivetrain. One could not just swap out the currency within an economy and expect everything to continue functioning. It would be like swapping the fuel pump in your car to an electric battery and expecting everything just to work. At its core the concept of crypto currencies is deeply flawed. Currencies require oversight, as part of a larger economy. Without confidence in the stability of a currency and the availability of credit an economy would grind to a halt. Crypto bulls have no appreciation or understanding of the work done by governments and federal reserve banks to maintain currency value and ensure an economy will continue to function, jobs will be created, wages will grow, business will grow and expand. Though even in theory, the idealist aims crypto was founded on are not actually resolved with the current implementations and if anything the irony is that crypto currencies make all of the identified problems worse. Avoiding a potential 2008 crash? Well the crash was caused by banks and other large companies believing certain assets had strong value, but they were exposed to be worthless and their foundations came crashing down. The solution? Create a new asset class based on nothing, with no actual intrinsic value, pump it to an huge value and wait for it to crash back as it’s real value is exposed. It’s the GFC all over again. Or getting into cryptos to get away from the banks? The solution? The unregulated, unreliable, insecure exchanges. The exchanges that control your asset worse than any bank (limiting what you can pair with, limiting when you can trade with unreliable uptime, charging deposit, withdrawal, transfer fees). The exchanges run by fraudsters manipulating the value of your assets for their own gains. The exchanges that are compromised regularly, potentially all reliant on a single person holding a single key who might just kick the bucket at any moment. Amazing redundancy. But this is the irony of crypto. For every problem with the current system that is attempted to be solved, ten new problems are created. With a desire for trustless, fee free, independent and secure asset management the most untrustworthy, expensive, slow, insecure, manipulated and controlled system is created and pushed. On the horizon is always the next something like peer to peer exchanges and faster ‘lightning’ networks to solve the current issues. But these issues have already been resolved. Problems that were solved 50 years ago are still a cutting edge solution in the crypto world. This is the irony of crypto, the belief of being on the cutting edge of a new world order. The reality is an unfeasible currency managed using broken, unregulated, dodgy ‘banks’ (aka exchanges). It is a beauty to behold, the belief in this broken concept is only rivalled by the anti vaxxer movement. No matter the science or economics explaining the reasoning of the current system there will be deniers, who will push ahead with their own broken concept of what is right. While trying to improve their health or finances, they only succeed in doing the opposite, this is the anti intellectual movement in full force. While berating you for being too dumb to understand crypto and the blockchain they will continue to ignore all advice from every successful economist because they are ‘shills’ and part of the conspiracy. This is the irony of crypto. Better get in and HODL before Moon!! |

| Essential details on bitcoin/crypto Posted by Mr_Deep_Research on 2019-02-16 15:13:46 |

| just to bring you up to speed. a currency is a price, it i s not an asset. nobody "buys dollars". nobody "invests in dollars". Graphing the "value of the dollar" over time is fucking stupid because the dollar is a price. Is like graphing the "weight of a kilogram" over time. Butters think dollars are investments because they generally have no money. bitcoin is fucking stupid. the inflation rate has always been higher than the dollar and will likely always be because if there was no block reward, transactions would cost > $25 each. the money to run the system comes from inflation right now and without that, it would cost $25 to transfer $1 between your own wallets" (do the math). when the reward goes toward zero, the devs will fix the block reward to something > 0 and create permanent inflation (unlimiting the number of bitcoins) because users won't pay $25 transaction fees. everyone will cheer that and the 21 million "limit" will be forgotten about. that fact that the devs can even do that shows how fucking stupid everything is. you can't unlimit the amount of gold in the world. bitcoin is not decentralized or trustless in any way. you trust the developers not to fuck everything up or delete transactions (as they did in 2010 with the "overflow bug"). you trust the > 50% miners to not block your transaction forever or chop the top of the chain off and start fucking around in other ways bitcoin is not immutable in any way. if you control > 50% of the hashing power, you can make a longer chain no matter how long the existing chain is (math). the only thing preventing that is the developers sticking checkpoints in the code which shows you that the chain with the most work is not "the chain". it is just the one the developers have picked. again, central authority. and if the developers decide they a different chain is "the chain", they can make it. thus, not immutable. the whole thing is a stupid pyramid scheme where people make up worthless tokens and run around screeching that people should buy them because other people will pay more for them in the future. unlike any other asset class, there is no underlying value. and no, it isn't a currency. it is not good for "all debts public and private", it is a less than zero sum game, worse than playing the slots in vegas. a blockchain is a linked list with hashes in each item pointing to a previous item. it isn't a database, it isn't indexed, it isn't a technology, it isn't new and with the idea of "mining" (longest chain is the one that wastes the most energy), it is slow as fuck and completely fucking worthless for anything but stupid pyramid schemes where the guy who makes up some tokens wants to pawn off processing transactions to others (miners) so he doesn't get arrested himself. carry on. |

| Posted by Georges on 2022-05-19 14:54:24 |

| Mr_Deep_Research says nobody "buys dollars", but why does the forex market has that much daily volume vs the dollar? anyway, bitcoin isnt a currency, but no one can tell if it will become one or not in the future. |

| Name: | (change name for anonymous posting) |

| Title: | |

| Comments: | |

| 1 Article displayed. |

Bumper Sticker Store

Bumper Sticker Store